06-Mar-2025 Inverted Duty Structure under GST

gst-refund #taxation #gstrate #gst_litigationThe concept of Inverted Duty Structure (IDS) under GST arises when the rate of tax on inputs is higher than the rate of tax on the output supply, leading to an accumulation of unutilized Input Tax Credit (ITC). To ease the financial burden on businesses, the GST framework allows refunds of the accumulated ITC under such specific situations. Navigating the IDS refund process requires a clear understanding of eligibility, documentation, and procedural requirements to ensure timely and hassle-free claims

Inverted Duty Structure under GST

By CA Pranav Kapadia and Varun Desai

While the provision of IDS refunds aims to enhance liquidity and promote fair tax compliance, businesses often face challenges such as procedural delays, documentation scrutiny, and evolving regulatory clarifications. The government has introduced Rule 89(5) of the CGST Rules, which lays down the formula for refund computation. In this article, we will explore the eligibility criteria, refund calculation and procedural steps surrounding IDS refunds under GST.

Goods and Services Tax (GST) is a destination-based tax system implemented in India to replace multiple indirect taxes. It subsumes taxes like VAT, excise duty, and service tax, reducing the cascading effect of taxation. Key benefits of GST include increased transparency, ease of doing business, and seamless input tax credit, leading to cost efficiency for businesses.

Despite the benefits of GST, certain structural issues create challenges for businesses. One such issue is the Inverted Duty Structure (IDS), where the rate of tax on inputs (raw materials or components) is higher than the rate of tax on the outputs. This leads to an accumulation of input tax credit (ITC) in the electronic credit ledger of the taxpayer, which leads to blocking of working capital for the businesses and many taxpayers struggle to utilize/encash this credit effectively.

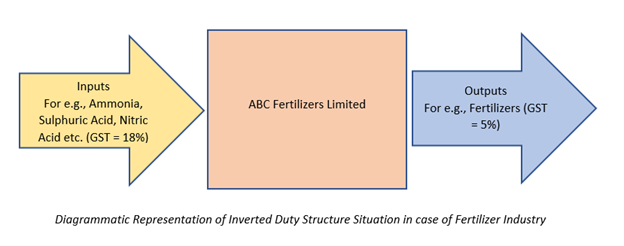

For e.g., in case of fertilizer industry, the applicable rate of GST on outward supplies (i.e., fertilizers) is 5%. However, the raw materials (For e.g., Ammonia, Sulphuric Acid and Nitric Acid) attract GST at the rate of 18%. This leads to accumulation of input tax credit in the electronic credit ledger. Even after setting off the output tax liability, there exists a substantial amount in the credit ledger which the taxpayer cannot utilize.

This leads to blocking of working capital and non-utilisation of the ITC which keeps on accumulating, since the tax payable on outward supplies is always lesser than the ITC availed by the taxpayer.

The entire process, from purchasing of raw materials to sales of finished goods, spans multiple months. For example, purchases might be made in the first month, processing could occur in the second month, and sales might take place in the third month, and so on. Additionally, there may be instances where certain months experience a higher volume of purchase transactions and lower sales transactions, while other months may see higher sales transactions with little to no purchases. As a result, establishing a direct correlation between purchases and sales is practically impossible. Therefore, a mechanism is needed to ensure that the taxpayer receives a refund of the accumulated Input Tax Credit (ITC) due to the inverted duty structure. This mechanism should account for the entire production process without requiring a one-to-one correlation between purchases and sales.

To resolve this issue, the government has provided a system of granting refund of accumulated balance of input tax credit to the taxpayers in situations where the rate of tax on inputs is higher than the rate of tax on outputs.

Refunds under GST are governed by Section 54 of CGST Act and Rule 89 of CGST Rules. The government has also issued a Circular No. 125/44/2019 dated 18-11-2019 for the said purpose.

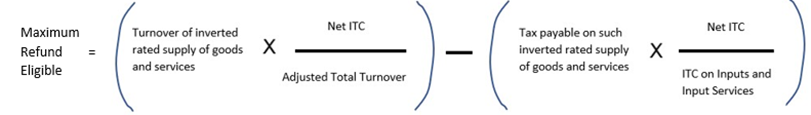

Refund under inverted duty structure is available only in case of inputs and a specific formula is used to calculate the refund amount. The formula is as follows –

Let us now understand each element of the formula in detail -

All the ITC that is availed by the taxpayer in GSTR 3B is classified into 3 categories, i.e., Inputs, Input Services and Capital Goods.

Net ITC includes only the ITC which is attributable to Inputs i.e., purchase of goods other than Capital Goods.

ITC on Input Services means the ITC on services used or intended to be used by the taxpayer.

It should be noted that only ITC availed on Inputs is eligible for claiming refund under the provisions of Inverted Duty Structure and there is no scope of claiming refund of ITC availed on input services and capital goods as per the formula provided.

Turnover of inverted rated supply of goods and services refer to the sales of goods made at a lower rate of tax as compared to the rate of tax on the corresponding purchases made.

For e.g., Sale of fertilizers at the rate of 5% while the rate of tax on the corresponding purchases made to manufacture the said goods are at 12%/18%/28%. Thus, this qualifies under the heading of inverted rated supply.

However, in case of sale of other chemicals, say at the rate of 18%, where the corresponding input purchases are at the rate of 18% itself, does not qualify for inverted rated supply.

Tax payable on inverted rated supply of goods and services means the output tax liability on such inverted rated supplies.

Adjusted total turnover means the total turnover of the taxpayer for the relevant period for which the refund application is filed.

The final amount of refund shall be the lower of the following limits –

- 1) Maximum refund calculated as per the formula prescribed in Rule 89(5),

- 2) Balance in electronic credit ledger at the time of filing GSTR 3B for the last month of the period for which the refund application is being filed;

- 3) Balance in electronic credit ledger at the time of filing of refund application.

Procedure for filing the refund application –

The application needs to be filed online through the GST Portal in the online Form GST RFD-01 along with details of ITC claimed and Outward supplies made.

If the proper officer concludes that the taxpayer has wrongly claimed a particular amount of tax as refund, then he will disallow that portion of the refund claimed and sanction only the balance amount which he determines as eligible.

In case the officer has disallowed the whole or part of the refund applied, the taxpayer now has 2 options to proceed further –

- 1) He can file an appeal against the rejection of refund. (For common FAQs on Appeals under GST, you may refer to our article – FAQs on Appeals under GST), or

- 2) He can file an undertaking for Form PMT-03 stating that he will not file an appeal against the refund rejection. In that case, the officer will accept the undertaking and issue an order for re-credit of the inadmissible refund amount back into the electronic credit ledger of the taxpayer. Such re-credited amount can be utilized to set off output tax liability in the future.

To conclude, the inverted duty structure is a unique situation that certain businesses might have to face. The above article attempts to clarify the concept of inverted duty structure and the refund calculation methodology prescribed in the GST law so that the refund procedure becomes hassle free for the taxpayer.