06-Feb-2025 FAQ's on Appeals under GST

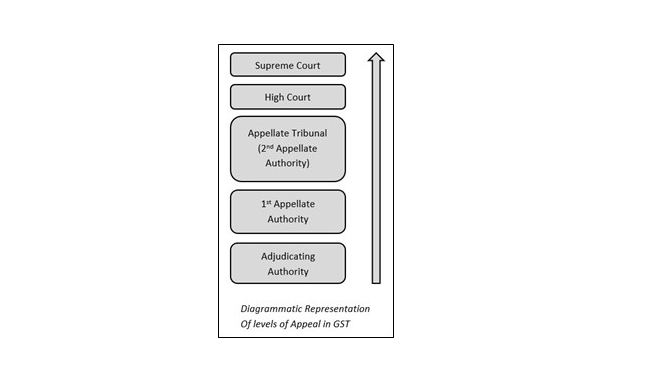

#gst_appeal #gst_litigationWith the increasing litigations in GST law, understanding the appeal process, timelines, and legal provisions is essential for businesses to safeguard their rights. This article addresses frequently asked questions (FAQs) on GST appeals, providing clarity on key aspects and procedures.

FAQ's on Appeals under GST

By CA Pranav Kapadia and Varun Desai

With the increasing litigations in GST law, understanding the appeal process, timelines, and legal provisions is essential for businesses to safeguard their rights. This article addresses frequently asked questions (FAQs) on GST appeals, providing clarity on key aspects and procedures.

- 1. Who can file an appeal under the GST law?

Any person who is aggrieved by any decision or order of an adjudicating authority (under the GST Act) can make an application to the higher authority (known as Appellate Authority) for granting relief against the unfavourable order.

- 2. What is the time limit for filing an appeal by the appellant?

As per Section 107(1) of the CGST Act, 2017, an appeal must be filed by the appellant within 3 months from the date on which the said decision or order is communicated to the appellant.

- 3. Is there a provision for condonation of delay in filing an appeal?

As per Section 107(4) of the CGST Act, 2017, the Appellate Authority may, if he is satisfied that the appellant was prevented by sufficient cause from presenting the appeal within the prescribed period, allow it to be presented within a further period of one month.

- 4. Can an appeal be filed by any GST officer against an order issued in favour of the taxpayer by another GST officer ?

As per Section 107(2) of the CGST Act, 2017, the Commissioner may, on his own motion, or upon request from the Commissioner of State tax or the Commissioner of Union territory tax, direct any officer subordinate to him to appeal to the Appellate Authority against the order passed.

The time limit for the same is six months from the date of order. An extension of one month may be granted by the Appellate Authority if it feels that there was sufficient cause which prevented the said appeal from being filed within the prescribed period.

- 5. Which is the form for filing GST Appeals?

Appeals to first Appellate Authority are to be filed using FORM GST APL-01 and appeals to the Appellate Tribunal are to be filed through form GST APL-05 on the GST portal.

- 6. Can appeals be filed against all types of orders ?

As per Section 121 of the CGST Act, 2017, not all orders passed by adjudicating authorities can be appealed against. In following cases, appeals cannot be filed -

- An order of the Commissioner or other authority empowered to direct transfer of proceedings from one officer to another officer

- An order pertaining to the seizure or retention of books of account, register and other documents

- An order sanctioning prosecution under this Act

- an order passed under Section 80 (extension of time limit of payments required to be made under the GST Act

- 7. Is it mandatory to dispute the whole amount of demand?

It is not mandatory to dispute the whole amount of demand. The GST Portal provides an option to the appellant to mention the amount of demand accepted and pre-deposit needs to be paid only on the balance amount. Also, the amount of liability accepted must be discharged.

- 8. Is the appellant required to make any payments for filing an appeal?

As per Section 107(6) of the CGST Act, 2017 no appeal shall be filed unless the appellant has paid –

- in full, such part of the amount of tax, interest, fine, fee and penalty arising from the impugned order, as is admitted by him

- a sum equal to 10% of the remaining amount of tax in dispute arising from the said order in relation to which the appeal has been filed (subject to a maximum of 20 crore rupees)

It is important to note that the maximum limit of 20 crores is prescribed in the CGST Act. Therefore, In case of orders demanding tax under CGST/SGST, the maximum limit will be 40 crores. The same applies to orders issued for demanding tax under the head IGST, whereby the maximum limit will be 40 crore rupees.

In appeals against orders relating to detention, seizure and release of goods and conveyances in transit, an amount equal to 25% of the penalty amount must be paid before an appeal is filed.

The Union Budget 2025 has proposed that 10% of penalty demanded will be required to be paid in cases where there is no tax liability but only penalty is demanded in the order.

This payment is known as ‘Pre-Deposit before Filing Appeals’.

- 9. How can the amount of pre deposit be paid?

The amount of pre deposit can be paid through either the cash ledger or the credit ledger.

The availability of utilization of ITC balance in the credit ledger to pay the pre deposit amount has been clarified by CBIC in Circular No. 172/04/2022-GST dated 6th July, 2022 and the same has been upheld by the Gujarat High Court in its judgement dated 30-Nov-2023 in the case of Shiv Crackers Vs Chief Commissioner of CGST & C.E. & Anr. [R/Special Civil Application No. 22979 of 2022] and by the Bombay High Court in its judgement dated 16-Sep-2022 in the case of Oasis Realty Vs Union of India [Writ Petition (St) No. 23507 of 2022].

- 10. Is there any time limit within which the decision on an appeal must be made?

Section 107(13) of the CGST Act, 2017 states that the Appellate Authority shall, where it is possible to do so, hear and decide every appeal within a period of one year from the date on which it is filed.

Also, 1st proviso to Section 107(13) states that where the issuance of order is stayed by an order of a court or Tribunal, the period of such stay shall be excluded in computing the period of one year.

However, it is important to note that this time limit is only advisory in nature and the Appellate Authority is not bound to decide on an appeal strictly within this time limit.

- 11. Can an appeal be withdrawn?

As per Rule 109C of the Central Goods and Service tax Rules, 2017, the appellant may file an application for withdrawal of appeal in Form GST APL 01/03W before issuance of show cause notice under Section 107(11) of the CGST Act, 2017 or before the issuance of an order under the same section.

However, if the final acknowledgement of the appeal in Form GST APL-02 has been issued, then the appeal can be withdrawn only subject to the approval of the said Appellate Authority and the Appellate Authority shall decide on the withdrawal within 7 days from the date of such application. (1st Proviso to Rule 109C)

- 12. Who can represent the appellant in case of appeals?

Section 116(1) of the CGST Act, 2017 states that any person who is entitled or required to appear before an officer appointed under this Act, or the Appellate Authority or the Appellate Tribunal in connection with any proceedings under this Act, may, otherwise than when required under this Act to appear personally for examination on oath or affirmation, subject to the other provisions of this section, appear by an authorized representative.

As per Section 116(2), the authorized representative may be –

- his relative or regular employee

- an advocate who is entitled to practice in any court in India, and who has not been debarred from practicing before any court in India

- any chartered accountant, a cost accountant or a company secretary, who holds a certificate of practice and who has not been debarred from practice

- a retired officer of the Commercial Tax Department of any State Government or Union territory or of the Board who, during his service under the Government, had worked in a post not below the rank than that of a Group-B Gazetted officer for a period of not less than two years

Provided that such officer shall not be entitled to appear before any proceedings under this Act for a period of one year from the date of his retirement or resignation;

- Any person who has been authorized to act as a GST practitioner on behalf of the concerned registered person.

- 13. What happens to the pre-deposit amount if the appellant withdraws and does not re-file the appeal?

In case the appeal is withdrawn and not re-filed, the pre-deposit amount is set off against the total demand of the order and the balance amount of demand becomes payable by the appellant.

- 14. Is the amount of pre-deposit paid at the time of filing the appeal, refundable?

Yes, if the appellant wins the appeal and the final amount payable as per the appellate order is less than the amount pre-deposited.