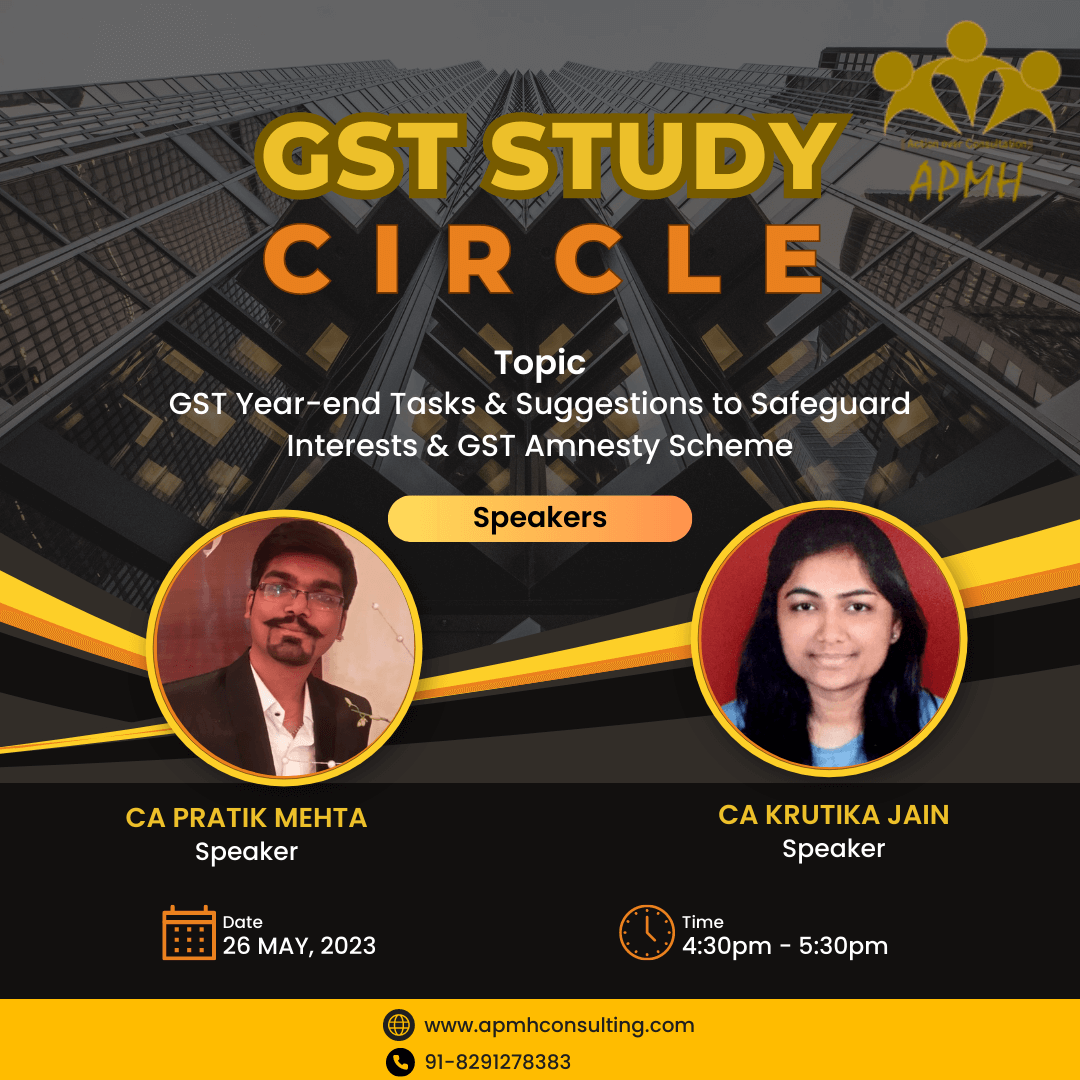

GST Study circle meeting on 26th May 2023

The webinar aims to provide valuable insights and practical guidance on the important GST year-end tasks that businesses should undertake to ensure compliance and optimize their tax strategies. Additionally, the speakers will discuss suggestions to safeguard your interests and leverage the latest Amnesty Scheme.

The webinar aims to provide valuable insights and practical guidance on the important GST year-end tasks that businesses should undertake to ensure compliance and optimize their tax strategies. Additionally, the speakers will discuss suggestions to safeguard your interests and leverage the latest Amnesty Scheme.

Topic: GST Year-end Tasks & Suggestions to Safeguard Interests & Amnesty Scheme

Speakers : CA Pratik Mehta and CA Krutika Jain.

Date : 26th May 2023

Time: 4:30 pm to 5:30pm

We highly encourage you to join this informative session, as it will equip you with the knowledge and strategies necessary to navigate the year-end tasks effectively and take advantage of the available amnesty benefits.

Here are the joining credentials for the online session for your ready reference.

https://us02web.zoom.us/j/89156995720?pwd=bXhkSjh4SEZHNWZNZk9XR2RrTWk0dz09