15-Jul-2025 Testing Blog : Justify Alignment Needed

#exportsundergst #zeroratedsuppliesExports are a vital component of India’s economy, and the GST regime provides significant benefits by treating them as zero-rated supplies. This allows exporters to claim refunds on input taxes or export without paying GST under a Letter of Undertaking (LUT). Understanding GST provisions relating of exports, ensures seamless compliance and maximized tax benefits.

"Justify alignment"

In the GST framework, exports qualify as zero-rated supplies, enabling businesses to claim refunds on input taxes or export without GST under a Letter of Undertaking (LUT). Navigating GST rules effectively ensures seamless compliance and maximized tax advantages for exporters. In our latest blog on exports, we explain the basics of supplies for export of goods/services and corresponding provisions for refund

Exports under GST (Needed Justify Alignment)

Exports play a crucial role in India's economic growth, and under the Goods and Services Tax (GST) regime, they enjoy special benefits to promote global trade. The GST framework treats exports as "zero-rated supplies", ensuring that businesses exporting goods or services do not bear the tax burden. Exporters can either claim a refund of the input tax credit (ITC) or export under a bond or Letter of Undertaking (LUT) without paying IGST. Understanding the compliance requirements, documentation, and refund mechanisms is essential for exporters to maximize benefits under GST. This article explores key aspects of exports under GST to simplify the process for businesses.

Under GST law, exports are defined in Section 16 of the IGST Act. The said act reads as follows –

“16. (1) "Zero rated supply" means any of the following supplies of goods or services or both, namely:—

- (a) export of goods or services or both;

...”

Zero rated – what and why

Now we understand that exports are classified as zero-rated supplies. But what does zero rated supplies mean?

Zero rated supplies means that the GST rate leviable on the said supplies is 0%. Please note that this is not to be confused with exempt supplies. Exempt supplies are the ones which are leviable to tax but for the exemption notification issued by the government. There is no express provision in the law itself which exempts such goods. Powers have been conferred on the Government to issue exemptions by way of notifications and it is by way of this power that the government exempts the supply of certain goods and services from the levy of GST.

However, in the case of zero-rated supplies, a specific provision has been incorporated into the GST Act itself to prevent the levy of GST on exports, as evident from the extract of Section 16 reproduced above.

Why is ‘zero rating’ on exports necessary?

Like any other indirect tax, GST is a destination-based tax i.e., the main intention of levying GST is to impose tax on consumption of goods and services. The concept note on GST also states that GST accrues to the place where the consumption of the goods/services take place1. This is in line with the international VAT/GST Guidelines issued by the OECD which suggest that ‘overarching purpose of a VAT is to impose a broad-based tax on consumption, which is understood to mean final consumption by households.2” Based on the destination principle, the tax should only be levied in the jurisdiction where the consumption takes place.

The guidelines further prescribe that one of the general principles of tax policy is neutrality i.e. business decisions should be impacted by economic rather than tax considerations.

If indirect tax is levied on exports, it would lead to an awkward situation. The exporting country would levy tax at its own rate and the revenue would accrue to that country (and then shared with the consuming country on the basis of revenue sharing principle, if any). Further, the importing country would give credit to the importer against the tax which was originally paid in the exporting country’s jurisdiction. This would change the nature of the tax from ‘consumption principle’ to the ‘origin principle’. Unlike the Double Tax Avoidance Agreements ( DTAA) under Income tax between various countries, there are no such agreements amongst various countries for Indirect Taxes.

Due to these reasons, there is a widespread consensus among WTO members that exported goods should be exempt from indirect taxes. Furthermore, the importing country should levy import duties and VAT/GST to ensure parity with locally produced goods.

India (who is also a WTO member) has therefore classified exports as zero-rated supplies, which is in line with the general consensus of the members of WTO.

Issues with Zero Rating (Justify Alignment)

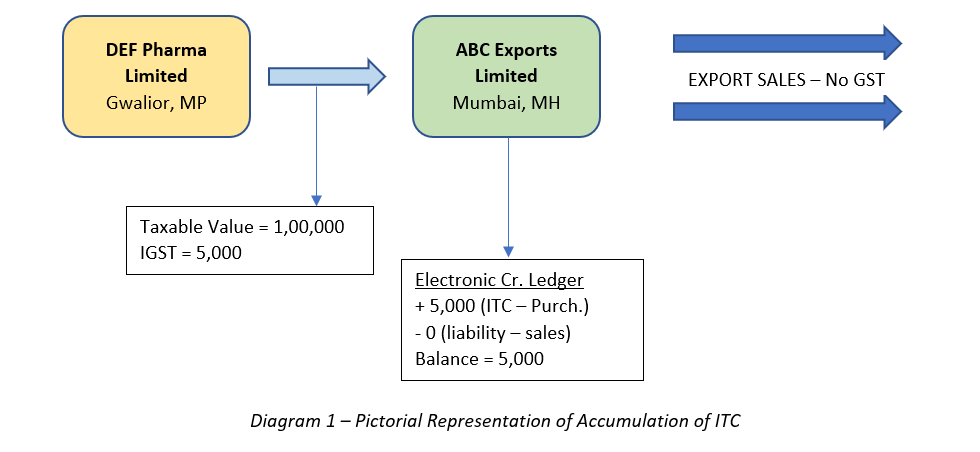

Zero rating on exports (thereby reducing output tax liability) is great for international trade. However, it poses a major issue for the Indian Exporters. Let’s consider a hypothetical example to understand the issue. ABC Exports Limited is an exporter of medicines situated in Mumbai, Maharashtra. It purchases medicines worth Rs. 1,00,000 (plus GST at 5% = Rs. 5,000) from DEF Pharma Limited, which is also an Indian entity situated in Gwalior, Madhya Pradesh. The purchases being eligible for ITC claim, ABC claims credit on the same and the GST component of the invoice gets added to the electronic credit ledger.

ABC then exports the medicines for $ 2,000 (Rs. 1,71,120). However, GST is not leviable on the said transaction. This has led to an accumulation of input tax credit in the electronic credit ledger of ABC. ABC can utilize the same only to set off liability against taxable supplies.

This leads to a situation where working capital of ABC is blocked and in the absence of a way to utilize the said ITC, it has become a cost to ABC. If ABC is not provided with an option to take benefit of the said ITC, ABC will have no choice but to add the GST Component to its cost thereby raising the price of its outputs. "Justify Alignment”.