12-Feb-2026 Revamping India’s Safe harbour framework for Enhanced Tax Certainty

#unionbudget2026 #safeharbourrules #fdiindia #internationaltaxIndia’s proposed revamp of the Safe Harbour Rules under the Income-Tax Rules, 2026 aims to strengthen tax certainty and enhance ease of doing business. The updated framework revises margins, relaxes eligibility conditions, and expands coverage to sectors such as IT/ITES, contract R&D, auto components, intra-group financing, data centres, and electronics manufacturing. It also introduces clearer profit attribution norms for foreign companies. Overall, the reforms are designed to reduce litigation, improve predictability, and position India as a more attractive destination for global investment.

The safe harbour provisions introduced into India’s transfer pricing regime in 2013 are now poised for a significant revamp, as the country moves to strengthen tax certainty. This reform is coherent, strategic and timely, in light of the three Kartavyas framework coined in the recent Union Budget and resonates with India’s broader aim of establishing itself as a preferred destination within global value chains — particularly electronics and the information and communication technology (ICT) sectors, including cloud and AI infrastructure. By fostering a predictable, dispute-averse, and investor-friendly tax environment, the revamp signals a clear intent to enhance India’s competitiveness in ease of doing business and attract more and more foreign investments.

The safe harbour was introduced as a streamlined tax certainty framework that seeks to relieve taxpayers falling under the Transfer pricing regime from hassles of its full-blown intensive provisions, also insulating them from litigation and aims to brings tax certainty for a block of years. The rules provided for margins or rates that tax authorities will accept without further audit for certain eligible transactions undertaken by eligible taxpayers under prescribed conditions. Once approved, these rates apply for a block of years and revisited by the tax department periodically.

Historically, high margins and stringent eligibility conditions posed significant discouragement for taxpayers to enrol into this scheme. However, the recent reforms seek to course-correct and recalibrate some of its deterrent parameters, broaden the accessibility, thereby removing longstanding impediments. We attempt to declutter below the provisions in its most recent avatar that are currently in draft form under the Income-Tax Rules, 2026.

- 1. International transactions

The rules prescribe specific operating profit margins or rates for various businesses for tax year 2026-27 as follows:

Transaction Type Definition & Scope Conditions / Threshold Safe Harbour Margin / Rate Validity (Years) IT Services Includes: 1. Software development services (business application, system development, porting, debugging). 2. IT enabled services (BPO, call centres, data processing, medical transcription). 3. Knowledge Process Outsourcing (GIS, HR services, engineering/design, animation, business/financial analytics, market research). 4. Contract R&D relating to software development. Excludes: R&D services other than contract R&D. Provides services with insignificant risk to a non-resident AE (foreign principal). Threshold: Aggregate operating revenue from these transactions ≤ ₹2000 Crore in the tax year. Operating Profit Margin ≥ 15.5% of Operating Expense (OE) 5 Intra-group Loans (INR) Loan advanced to a non-resident Associated Enterprise (AE) denominated in Indian Rupees. Excludes: Loans by financial companies/banks; credit lines/facilities with no fixed term. Lender: Eligible assessee. Borrower: Non-resident AE. Credit Rating: Based on rating of AE by SEBI and RBI-registered agency. Interest Rate ≥ SBI 1-Year MCLR (as on 1st April) + Spread: • AAA to A: +175 bps • BBB- to BBB+: +325 bps • BB to B: +475 bps • C to D: +625 bps • Unrated & Loan ≤ ₹100 Cr: +425 bps 3 Intra-group Loans (Foreign Currency) Loan advanced to a non-resident AE denominated in foreign currency. Excludes: Loans by financial companies/banks; credit lines/facilities with no fixed term. Lender: Eligible assessee. Borrower: Non-resident AE. Credit Rating: Based on rating of AE by SEBI and RBI-registered agency. Reference Rate (6-month rate): • SOFR (USD) + 45bps • EURIBOR (Euro) • SONIA (GBP) + 30 bps • TORF (Yen) + 10 bps • BBSW (AUD) • Compounded SORA (SGD) + 45 bps Interest Rate ≥ Reference Rate + Spread. Spread – Loans ≤ ₹250 Cr: • AAA to A-: +150 bps • BBB to BBB+: +300 bps • BB+ to D/Unrated: +400 bps. Spread – Loans > ₹250 Cr: • AAA to A-: +150 bps • BBB to BBB+: +300 bps • BB+ to B-: +450 bps • C to D/Unrated: +600 bps 3 Corporate Guarantee Explicit corporate guarantee extended to a wholly owned subsidiary (non-resident) for short/long-term borrowing. Excludes: Letters of comfort, implicit guarantees, performance guarantees. Provider: Eligible assessee. Recipient: Wholly owned subsidiary. Condition: Guaranteed amount thresholds determine rating requirements. Commission/Fee ≥ 1% per annum on the amount guaranteed 3 Contract R&D (Generic Pharma) Contract R&D services wholly or partly relating to generic pharmaceutical drugs. Definition: Drug comparable to one already approved by regulatory authority in dosage, strength, route, quality, and use. Eligible Assessee: Provides services with insignificant risk to a foreign principal. Threshold: Aggregate operating revenue < ₹300 Crore. Operating Profit Margin ≥ 24% of OE 3 Auto Components (Core) Engine/engine parts, transmission/steering parts, suspension/braking parts, or Lithium-ion batteries for EVs. Eligible Assessee: Engaged in manufacture and export. Condition: 90% or more of total turnover must be in the nature of Original Equipment Manufacturer (OEM) sales. Operating Profit Margin ≥ 12% of OE 3 Auto Components (Other than Core) Auto components other than "core" components defined above. Eligible Assessee: Engaged in manufacture and export. Condition: 90% or more of total turnover must be OEM sales. Operating Profit Margin ≥ 8.5% of OE 3 Receipt of Low Value-Adding Services Support services not part of core business (e.g., HR, accounting, IT support). Excludes: R&D, manufacturing, sales/marketing, financial transactions, extraction. Eligible Assessee: Recipient of services from foreign group members. Threshold: Aggregate value (including markup) ≤ ₹10 Crore. Condition: Accountant must certify cost pooling and allocation keys. Mark-up ≤ 5% 3 Data Centre Services Services provided by data centres using physical infrastructure (land, power, servers, networking) in India. Excludes: Data hosting services. Provider: Eligible assessee. Recipient: Foreign company. Operating Profit Margin ≥ 15% of OE 3

The rules also prescribe criteria of insignificant risks attributable to the eligible assesses. In fact, in terms of contract research and development activities the requirements for insignificant risks are pretty much aligned with Circular No. 06/2013 [F NO. 500/139/2012], dated 29-6-2013 that was issued given the highly controversial and diverging views adopted by the taxmen in dealing with matters around contract R&D centres and further shaped up by the judicial precedents like GE India matter on characterisation of R&D centres.

2. Safe harbour income attribution for eligible businesses of foreign companies

Improving tax certainty in areas like attribution of profits to permanent establishment (PE) by expanding scope of presumptive taxation and safe harbours, is one of the key discussion points in the working paper published by NITI Aayog’s Consultative Group on Tax Policy released on 3 October 2025, that talks specifically about taxation frameworks for foreign investors in India in a bid to boost FDIs. The Government seems to have acted on the recommendations by expanding its income attribution safe harbours. In particular, these provisions now cover income attribution for non-residents with a business connection in India, specifically in following eligible businesses in India -

i) Raw Diamonds: Selling raw diamonds in a notified special zone.

ii) Component storage and contract manufacturing: Storage of components in a custom bonded area for sale to a contract manufacturer for producing specified electronic goods (e.g., mobile phones, laptops).

The recent inclusion of the supply and storage of components for use by contract manufacturers in producing specified electronic items in the wide carousel of transactions covered under safe harbour provisions is a welcome move. To give a backdrop, the Government of India introduced the 'Manufacture and Other Operations in Warehouse Regulations, 2019' (‘MOOWR’) Scheme in October 2019 that facilitates duty free import of inputs and capital goods for manufacturing and other operations in a bonded manufacturing facility, for the purpose of exports. On the other hand, it allows deferral of import duty to the extent manufactured goods cleared in the domestic market. Ample supply and storage of components into the bonded warehouse is critical to ensure just-in-time logistics for contract manufacturers of electronic goods in India. Joining the pieces, this current amendment now even attempts to bring tax certainty to profits attributable in India towards these manufacturing / warehousing activities done in the bonded warehouse. Like any other presumptive tax-based schemes, if this safe harbour is exercised, no further deduction for expenditure or depreciation is allowed on the income.

Safe Harbour Margins:

Transaction Type Definition & Scope Conditions & Thresholds Safe Harbour Description (Attributed Income) Selling of Raw Diamonds Scope: Business of selling raw diamonds (uncut, unpolished, non-conflict) in a notified special zone Eligible Assessee:Foreign company engaged in diamond mining. Income chargeable under "Profits and gains of business or profession" 4% of Gross Receipts from such business. Storageof Components (Contract manufacture) Scope: Storage of components in a custom bonded area (warehouse) for sale to a contract manufacturer (Indian company) to make specified electronic goods. Specified Goods: Mobile phones, laptops, tablets, servers, sub-assemblies, hearables/wearables. Eligible Assessee:Foreign company. Income chargeable under "Profits and gains of business or profession" 2% of Gross Receipts from such business.

These provisions aim at consolidating the already advantageous position of India’s diamond cutting and polishing sector as well as give further fillip to establishing India as a key manufacturing hub within the global electronic goods supply chains.

3. Specified Domestic Transactions:

The safe harbour rules are also prescribed for certain prescribed specified domestic transactions that were sought to be tested in conformity with the arm’s length requirements. The transaction details, their scope, conditions and safe harbour indicators are detailed below:

| Transaction Type | Definition & Scope | Conditions & Thresholds | Safe Harbour Description |

|---|---|---|---|

| Supply, Transmission, or Wheeling of Electricity | Scope: Domestic transaction involving the supply, transmission, or wheeling of electricity. | Eligible Assessee: Government Company (as defined in Companies Act, 2013) engaged in generation, supply, transmission, or distribution. | The Tariff is accepted if determined or methodology approved by the Appropriate Commission (e.g., CERC/SERC) under the Electricity Act, 2003. |

| Purchase of Milk or Milk Products | Scope: Purchase of milk or milk products by a co-operative society from its members. | Eligible Assessee: Co-operative Society engaged in procuring and marketing milk/milk products. | The Price is accepted if fixed by the Government Notification (prices for purchase from members must be available in the public domain). |

Certain reliefs are granted under the documentation requirements for such eligible specified domestic transactions.

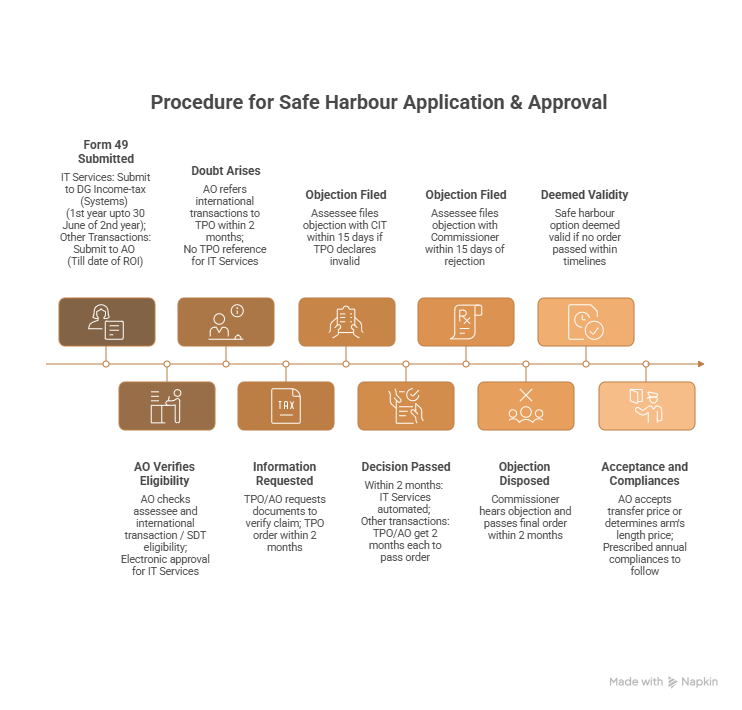

4. Procedural aspects

Some salient features of the safe harbour process:

a) Application: For generally all other transaction categories, the taxpayer must furnish Form No. 49 to the Assessing Officer (AO) on or before the due date of the tax return but on or after the day of submission of return of income to opt for the safe harbour provisions. In case of IT services the application can be made any time during the 1st of the block of 5 tax years that

b) Verification: The AO or Transfer Pricing Officer verifies eligibility. If no order is passed within a specified timeline (generally two months from receipt of reference), the option is treated as valid. The verification process in case of IT service transactions is completely handled electronically with a 2 month approval window handled at the end of the AO

c) Restrictions: Safe harbour does not apply to transactions with AEs in "no tax or low tax" countries (MMR tax rate < 15%).

d) No comparability adjustments allowed: No comparability adjustments e.g. working capital adjustments, inventory intensity, etc. can be claimed if safe harbour is opted.

e) TP Compliances: The taxpayer opting and accepted under the safe harbour is required to fulfil the transfer pricing documentation requirements and also furnish a report under Form No 48 (erstwhile Form 3CEB)

f) Mutual Agreement Procedure (MAP): If Safe Harbour is accepted, the assessee cannot invoke MAP under tax treaties in terms of corresponding adjustments.

It remains worthwhile to note that the current safe harbour provisions are in draft stage as enshrined in the draft Income tax Rules, 2026 and open for comments.

How businesses and MNEs should prepare to avail this beneficial scheme?

Businesses desiring to consider safe harbour regime, should initiate discussions with their transfer pricing experts early on, weigh the costs and benefits between opting for this scheme vis-à-vis regular route, assess the functional characterisation of their international transactions and identify whether they fit into the eligibility requirements and seek tax certainty at the earliest. This may be an opportune time for IT companies to revisit their strategies, engage with foreign counterparts, and revalidate existing service arrangements. Where beneficial, they may consider availing themselves of the scheme, and presuming these draft rules attain finality in the same form, applications could perhaps be acceptable as early as from April 2026 onwards. Such early tax certainty as a consequence would be a clear advantage from an operational transfer pricing perspective.

APMH Comments

Seemingly majority of foreign multinational entities operating their small captive subsidiary entities in India have been particularly weary of extensive Indian Transfer Pricing regulations and the safe harbour provisions while in place since 2013 were largely made superfluous thanks to narrow scope and higher acceptable operating margins. Hopefully these welcome developments could improve this image. More and more taxpayers having eligible international transactions are definitely encouraged to avail these safe harbour provisions here onwards since they could drastically save them heavy benchmarking and long drawn litigation costs.

Conclusion:

The revisions are clearly benevolent in nature as they seek to consolidate IT service categories, lower prescribed margins that better reflect business and economic realities, raise the eligibility bar and introduce clearer and more automated procedures. These developments mark a significant step toward greater tax certainty, reduced litigation risk, and enhanced global competitiveness for India’s digital and global supply chain sectors.