19-Aug-2025 Get Ready for the UAE’s Mandatory eInvoicing Programme (Effective July 2026)

#uaeeinvoicing #digitaltax #peppol #erpintegrationFrom July 2026, eInvoicing will be mandatory in the UAE. This move aims to digitize compliance, improve transparency, and streamline tax reporting. Businesses should prepare early by integrating ERP systems, selecting accredited providers, and training teams.

Introduction

Are you prepared for the UAE’s eInvoicing mandate coming into effect by July 2026 (Phase 1)?

Whether you're a supplier, manufacturer, service provider, or contractor in the UAE, this change directly affects your invoicing and tax reporting processes.

In this article, you will get to know what the UAE eInvoicing Programme means, why it's being implemented, and what action steps your business must take to stay compliant and competitive.

✅ What is eInvoicing in the UAE?

Electronic Invoice: An invoice issued, transmitted, and received, through the Electronic Invoicing System, in a structured electronic format that enables automatic and electronic processing.

It is a structured form of an invoice data that is issued and exchanged electronically between a supplier and a buyer and reported electronically to the UAE Federal Tax Authority.

❌ Not considered eInvoices:

- Unstructured invoice data issued in PDF or Word format

-Images of invoices such as JPG or TIFF

-Unstructured HTML invoices on a web page or in an email

-OCR (Scanned paper invoices)

-Paper invoices sent, like images, via fax machines

🎯 Why is the UAE Moving to eInvoicing?

Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization, and automation will help near real-time exchange of invoices and facilitate seamless tax reporting to the UAE Federal Tax Authority.

The UAE's intention to introduce eInvoicing by 2026 reaffirms its strong commitment to rapid innovation and the digitalization of its economy. The Ministry of Finance has outlined several key objectives for this initiative:

UAE eInvoicing – Key Objectives & Benefits

Key Objectives

Core Benefits for Businesses

- 1. Digitization – Reduced human intervention in tax processes and fully digital integration for UAE’s fiscal ecosystem.

- 2. Effectiveness – Greater transparency in transactions, improved audit capabilities, and a stronger compliance culture.

- 3. Taxpayer Experience – Enhanced convenience for taxpayers and system users.

- 4. Efficiency – Cost optimization, faster processing times, reduced paper wastage, and support for sustainability goals.

- 5. Compliance – Minimized tax gaps, maximized adherence to VAT laws, and targeting the shadow economy through structured reporting.

- 6. Economic Contribution – Boost to economic growth and competitiveness, leveraging big data for better policy and decision-making.

🏗️ UAE’s eInvoicing Model: The 5-Corner Peppol (DCTCE) Framework

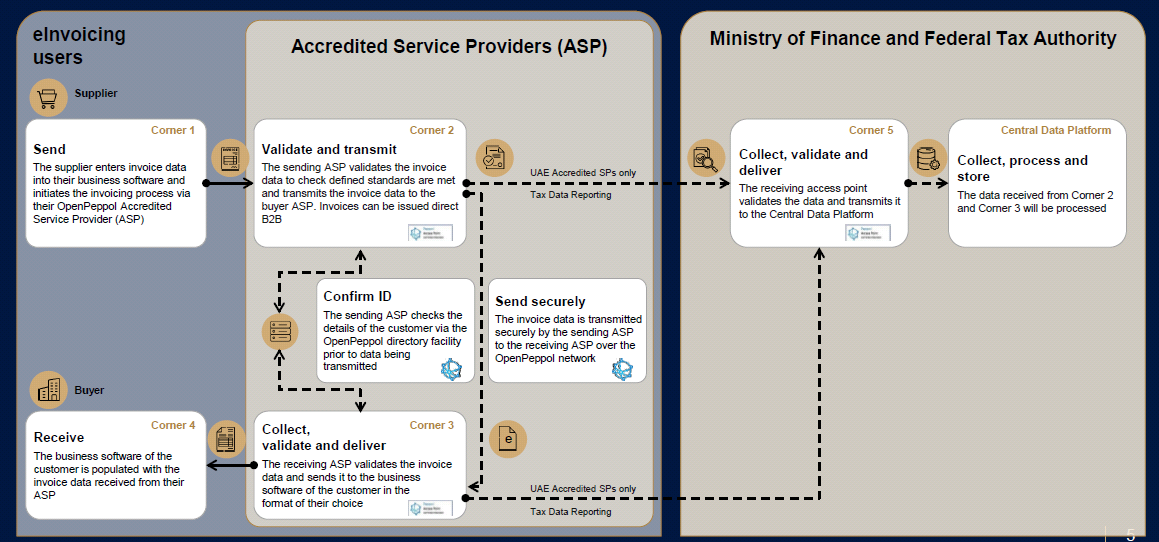

The UAE has adopted the Decentralized Continuous Transaction Control and Exchange (DCTCE) model, also known as the 5-Corner Peppol model.

🔄 How the 5-Corner Model Works:

1. Supplier creates invoice via their ERP software integrated with a Peppol-certified ASP

2. Sending ASP validates the invoice and sends it through the Peppol network

3. Receiving ASP delivers the invoice to the buyer’s ERP in real-time

4. Buyer receives invoice data automatically in structured format

5. FTA’s Central Data Platform collects, validates, and delivers data from UAE-accredited SPs only from Corner 2 & 3.

🗓️ Timeline for eInvoicing UAE – Key Dates

| Phase | Timeline |

|---|---|

| Development of the SPs Accreditation Requirements and Procedures | Q4 2024 |

| Development of the UAE Data Dictionary | Q4 2024 |

| Drafting of Legislation | Q2 2025 |

| Phase 1 Go live for Reporting | July 2026 |

🧩 What Do Businesses Need to Do?

Here’s your action plan to prepare for UAE eInvoicing:

1. ✅ Understand the Format

Familiarize your team with UAE-PINT (Peppol International standard).

2. ✅ Choose an Accredited Service Provider (ASP)

Partner with a certified Peppol ASP with legal presence in the UAE, ISO/IEC 27001 certification, and encryption.

3. ✅ Integrate Your ERP Software

Ensure your ERP can create and transmit structured invoices.

4. ✅ Conduct Testing

Run test invoices and simulate data exchange before go-live.

5. ✅ Train Internal Teams

Train your finance, IT, and compliance teams. & automatically exchanges eInvoices between Supplier and Buyer and reports tax data to the FTA

6. ✅ Use eInvoicing to Your Advantage

Automate and optimize your invoice lifecycle to reduce cost and errors.

📣 Final Thoughts: Don’t Wait Until 2026

UAE eInvoicing is not optional. It is mandatory starting July 2026.

The earlier you start, the smoother the transition. Use this opportunity to digitize your compliance and streamline operations.

FAQ:

UAE's Mandatory eInvoicing Programme (Effective July 2026)

To ensure a smooth transition into the upcoming eInvoicing regime, the UAE Federal Tax Authority (FTA) has released a detailed set of Frequently Asked Questions (FAQs). These cover practical, legal, and technical aspects of the new framework – from invoice formats and integration requirements to handling special scenarios like exports, self-billing, and VAT group arrangements. The FAQs are intended to serve as a ready reference for businesses to interpret and implement the requirements correctly.

1. Can an invoice contain taxable supplies along with exempt or out of scope supplies?

Yes, an invoice can contain taxable transactions, along with exempt or out of scope transactions.

2. Will it be required that every legal entity within a VAT tax group must integrate with an Accredited Service Provider separately or all the entities that are part of VAT tax group will have a single integration through the representative member?

Each member of the VAT group must have an endpoint via a UAE Accredited Service Provider.

3. How eInvoices will be exchanged with overseas customers? Will they be required to register with an UAE eInvoicing service provider as a customer?

“In case of exports, if the foreign buyer is already registered within the Peppol network, then the end point (electronic address) of the buyer is required to be provided. If they are not registered, then a dummy end point will be provided. In such cases exchange of document will not happen via the Peppol network, however, the Corner 2 (SP of seller) will continue to report the invoice to Corner 5. The seller is required to send the invoice to the buyer outside the network such as via email. It is not mandatory for the overseas buyer to register with a UAE eInvoicing Service Provider if he is not obligated to do so as per the UAE VAT and Corporate Tax law.”

4. Who will create and exchange the eInvoice in case of Self-billing?

In case of self-billing the buyer (customer) should create the eInvoice and will exchange the document with the seller and will also report to the FTA via the Accredited Service Provider

5. What happens when the Service Provider discovers an error in the invoice?

Should there be an issue with the invoice, the Accredited Service Provider shall return the invoice to the issuer.

6. What are the activities that a business should prepare for?

The business should analyze their transactions and the resulting invoicing data against the data dictionary and ensure that they are compliant Once the list of Accredited Service Providers is published by MoF, the businesses need to enter into a commercial arrangement with one of them and work on the integration between their systems to transmit the invoice.

7. Does business to business (B2B) include also businesses not VAT registered?

The eInvoicing framework encompasses all business-to-business (B2B) and business-to-government (B2G) transactions, regardless of the VAT registration status of the entities involved.

8. Can we develop, internally, our own eInvoicing solution?

Only an Accredited Service Provider can exchange and report invoices. Those who intend to be an Accredited Service Provider shall strictly adhere to the UAE Accreditation Procedures (yet to be published) and all the underlying requirements including the SLAs that need to be adhered to. Even if a business would like to be an Accredited Service Provider, as part of the eInvoicing exchange, it is important to acknowledge that the eInvoice data still needs to be shared with the buyer’s Accredited Service Provider.

9. Will there be any QR codes printed on the eInvoices?

There is no requirement for QR codes to be printed on the eInvoices.

10. Should e-Invoicing be in English, or is Arabic mandatory?

Arabic is not mandatory; e-Invoicing should be in English